Early in February the Ealing Gazette carried an article by Rupa Huq, MP for Ealing Central and Acton, supporting Britain’s continued membership of the European Union. My colleague and our GLA candidate, Alex Nieora, responded with a letter, which was edited down, and I with a fuller article, for which, predictably, space could not be found. So here is the full story, starting with Rupa Huq’s original article. I reproduce them without comment as each speaks for itself.

Rupa Huq’s Article.

“The word ‘crisis’ tends to be much over used in politics. Every year we have an NHS winter crisis and I have even raised the spectre of a curry crisis in the House of Commons before Christmas last year to George Osborne. But on the fate of our European membership it is no exaggeration to say that it would be nothing short of a crisis if we were to exit. To leave behind our biggest trading partner would put jobs and growth at serious risk.

Europe has also been a source of social reforming legislation, like maternity and paternity leave for new parents. EU competition agreements have brought down airline ticket prices. It is by working together with our European partners that we can catch criminals who do not operate within national borders through mechanisms such as the European arrest warrant. Our island is much stronger with the combined might of 28 nation states rather than the fanciful idea that we could ever go it alone.

Implications are wide-ranging – the universities’ science research budget that is working on cures to fatal diseases only functions due to European funding. David Cameron does not really want to leave but he is managed to have his tail wagged by a dangerous minority of extremists and Euro obsessives in the Conservative party. He is now boxed into a corner with his renegotiations, which are only being conducted to appease the Eurosceptic headbanger wing of his party – a rash promise made when he saw support ebbing away to UKIP. It is a sad day when government policy appears to be written by Nigel Farage.

In an age of globalisation we are part of numerous international alliances – NATO and the UN are others. It has been claimed that our historical ties to the Commonwealth act as an impediment to our playing a full part the EU. This is far from the case – it is not a mutually exclusive relationship. We can have the best of all worlds by participating in both Commonwealth on the one hand, with the Queen as figurehead and countries that once formed the empire, and on the other the European Union, which has so crucially kept the peace post World War Two in a continent previously ravaged by two world wars in a short space of time”

Alex then responded as follows:

“I write in response to Rupa Huq MP’s opinion piece in the Ealing Gazette last week. Contrary to what Dr. Huq’s asserts most of UK trade is not concluded with the EU. UK businesses now trade more with the rest of the world than with the EU, although the EU prevents the UK from signing trade agreements with other countries. This means that exports to the UK from developing world nations such as, for example, the Congo are forced to pay tariffs as they cross the EU Common Customs Border putting Congolese exporters at a competitive disadvantage. Moreover EU regulations act as a hindrance to the 80% of UK small and medium sized businesses that do not trade with the EU, while protecting corporate interests.

Dr. Huq mentions ‘European funding’ for science research without realising perhaps that the UK now pays the EU a staggering £12 billion more per year than the paltry 49p in the £ which it gets back from the EU. There is no ‘EU funding’ Dr. Huq – it is British taxpayers’ money.

Dr. Huq talks about EU ‘’competition agreements’’ but overlooks the impact that the 30,000 strong permanent corporate lobby in Brussels has on legislation that imposes restrictions and obstacles for would be competitors and smaller businesses. I doubt she has heard of gallium arsenide. It’s a compound semi-conductor used in microelectronics to make smart phones, integrated circuits, solar panels etc. Great you would think. Well French corporate interests have succeeded in getting the EU to ban gallium arsenide across the EU commencing from this year because it is a threat to their silicon based manufacturing interests. And the worst part is the UK’s MEPs who make up barely 8% of the European Parliament are powerless to do anything about this, or indeed anything else.

Perhaps Dr. Huq has heard of TTIP, the Transatlantic Trade and Investment Partnership deal between the EU and the US which threatens the NHS, by opening up public services to competition from the private sector and allowing corporates to sue governments who enact policies that negatively impact their profits. Both UKIP, Labour and other MEPs voted against these terms in the European Parliament but were outvoted no thanks to the small and ever decreasing British influence in the EU. While in the EU the UK can do absolutely nothing to prevent the implementation of TTIP, or indeed to renationalise the railways if it so wanted (due to the First Railways Directive) or a whole raft of other policy areas.

Dr. Huq disingenuously says the word ‘crisis’ is overused before writing ‘every year we have an NHS winter crisis’. Perhaps I might remind her that the NHS is indeed in crisis, and the last Labour government is largely to blame. The NHS is riddled with extortionate debt from decades of misguided PFI contacts. The NHS owes £80bn in PFI loan unitary charges. Next year alone trusts will make some £2bn in repayments. While PFI contracts were started by the Conservative government under John Major under the Labour government between 1997 and 2008 90% of all hospital construction funding was under PFI agreements.

Perhaps she is further aware but conveniently overlooks that each week politicians send £350 million to the EU net – that’s enough to build a new hospital every week. Dr. Huq mentions social reform legislation from the EU but omits to mention that most social reform and welfare state legislation was introduced by the UK Parliament a long time before the UK joined the EEC as it then was. As Tony Benn would have been the first to tell her the British government can just as easily pass social reform legislation as the EU but at a far less national debt accumulating cost.

The only crisis will happen if British voters listen – to use your own terms, Dr. Huq – to ‘dangerous extremist’ pro EU politicians”

And my contribution was

“Rupa Huq’s article last week claiming that Britain would be stronger in Europe is profoundly mistaken on so many fronts. Her case is purely negative and concentrates on what she perceives to be the risks of leaving, not mentioning a single one of the many far greater risks of staying in.

She starts by claiming that it is necessary for Britain to stay in the Single Market. Others have similarly accused UKIP for failing to give a clear picture of what it would be like outside. WRONG on both counts! We have always said that we would take up again our vacant seat at the World Trade Organisation (WTO) and trade with the EU on exactly the same basis that the US, China, Japan and many others do so successfully at present. That automatically would be the situation immediately after Brexit.

Quite separately there is the proposition that we could negotiate a new treaty with the EU effectively giving us zero-tariff access to the Single Market as at present. That of course remains to be seen, but don’t forget we trade at a huge deficit with the EU. So the betting is not only on the EU being the more desperate to continue with the current arrangements, but also that without a deal a bit of old-fashioned protectionism would in fact be to our advantage. Yes, trade volumes in both directions would be lower, but so would the trade deficit. And trade deficits export jobs. Any loss of jobs from a reduction in exports would be more than offset by job creation from import substitution. The import tariffs would help fund our public services and reduce our fiscal deficit, and the reduction in international trade volumes would save energy. Further the SM is highly unstable, like removing the bulkheads from an ocean-going oil tanker, thereby undermining economic growth. Thus four strong positive reasons for not re-joining the Single Market. Whilst we would not be the first to raise tariffs, we would of course respond in equal measure if tariffs were raised against us. So please, do not lose any sleep over this issue. We can handle it either way.

Dr. Huq then claims we would lose all the beneficial employment and other legislation we have derived from the EU. WRONG again! The day after Brexit the statute book would remain exactly the same as now. We can then decide for ourselves whether we keep those laws, change them or ditch them.

Next she claims our security would be at risk without solidarity within the EU. Still WRONG! There will be nothing to prevent us from co-operating fully with Europol or any other institution on the continent where we have a mutual interest in so doing. She claims that peace in Europe since WW2 has been kept by the EU, whereas most commentators attribute this success to NATO. Even today the EU has no significant military capability, though of course Brussels is itching to spend yet more money on what inevitably will be a fractious and ineffective force.

Then she claims we are safer with mechanisms like the European Arrest Warrant. This is a bit like saying we would be safer under a dictatorship. What about human rights? In this country a person is innocent until proven guilty. Not so on the continent where, under the Napoleonic Code, it is the other way around. She talks of the ‘combined might’ of the 28 states. Excuse me? What combined might? Not been very apparent during the refugee crisis, has it? And of course our influence as one of 28 countries is next to nothing, as David Cameron is currently demonstrating.

Next comes the assertion that our universities and other current recipients of EU funding would lose that funding. Also WRONG! Because we pay into the EU more than we get out we shall save not only the net deficit on funding, now some £12 billion a year, but also the value of all the funds we currently receive. We can, if we wish, guarantee that all current EU payments into the UK will continue £ for £ from those savings instead.

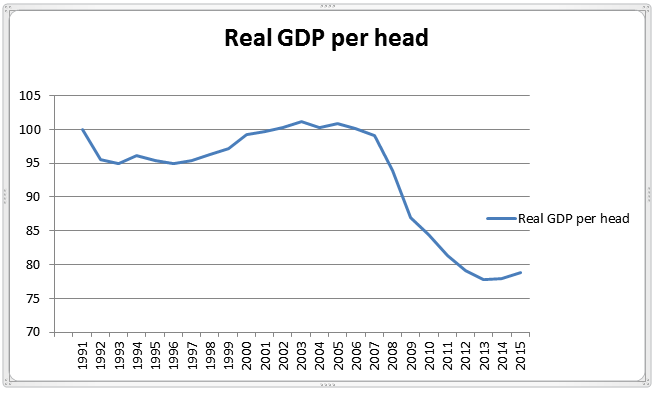

At least Dr. Huq has not repeated the hoary old canard that Britain would lose jobs if we left the EU. I assume simple logic has now informed her that once we control our borders, only possible outside the EU, the labour market will tighten because of the fall in the supply of workers. Leaving the EU will be good for both jobs and wages – an end to wage compression and a start to reducing the income spread and all the adverse effects of overcrowding such as the housing crisis.

Dr. Huq’s letter is full of emotive words such as ‘fanciful’, ‘headbanger’, ‘extremist’ and ‘obsessive’. She even claims that ‘it is a sad day when government policy appears to be written by Nigel Farage’! This is sure sign of a politician on the back foot. Let’s have fewer personal insults and more well-researched argument. I see UKIP as a libertarian centrist party committed to getting Britain out of the European Union. We always have been. We believe strongly in fairness and human rights as well as creating a freer society for those who want to be creative and enterprising. We call time on Labour’s deceitful propaganda.”