Delighted to have been reselected to fight the Ealing Southall constituency for UKIP, and have already received warm greetings on many a doorstep. You can download here both my election leaflet and postal election address. The former was really designed in anticipation of the 2018 local elections and was just about to go for printing when the election was announced, so I just added a banner at the top. The latter only gives me a few words to add to a central office designed template, but I hope I have got the essence of the situation across.

Here though is a much fuller Election Address. In addition there is a shorter hustings address thereafter.

“I should like to talk about two issues this evening. First there is the absolute Horlicks of a start Theresa May has made to her Brexit negotiations. At this rate she will end up with a bummer of a deal with the EU, claim it is the best thing since sliced bread, and then ram it through Parliament on the back of her temporary blip majority. We could then be stuck with it, which would be an absolute betrayal of all those who voted to LEAVE in the referendum. So what can we do about it, if anything?

Second I want to talk about funding so we can end austerity and at the same time resuscitate our public services to the standard we all want and expect. I will show you how UKIP, using our libertarian principles, could raise £150 billion pounds of new money without frightening the horses.

But first of all, why am I here at all? Why is UKIP still here? After all we won the referendum so surely that is job done for UKIP and we can now all quietly retire?

Unfortunately it is much more complicated than that. As I have already mentioned, Brexit in an acceptable form is still far from certain. For us this election is about votes, not seats. Last time we chalked up over 4 million votes and that made an impact. If we can do better this time, which will be a tall order as we are standing down in a number of seats for strategic reasons, putting country before party, we can make an even bigger impact. UKIP is the only pro-Brexit party that can mount a constructive Opposition. The others will of course mount destructive ones, but that is not what we want. So your vote for UKIP will count. A vote for any other candidate in this safe seat will not make a jot of difference. It will be a wasted vote.

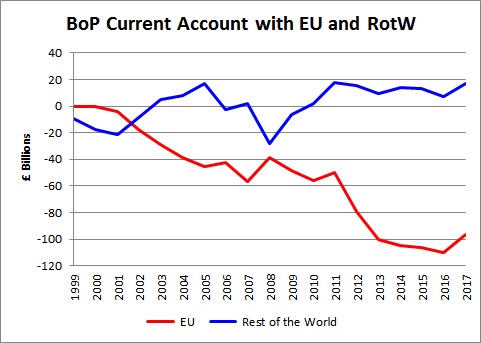

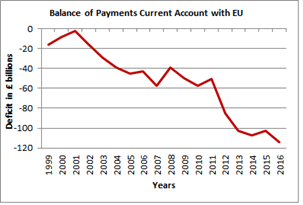

So what about Theresa May? One of the biggest differences between the Tory version of Brexit and UKIP’s relates to trade. The Tory’s want a trade deal with the EU whereas we have always said we do not. There are three good reasons for this. First, if you plonk a trade deal on top of an existing deficit, you are only going to increase that deficit. That’s just simple mathematics. If imports and exports both rise by roughly the same percentage, which is after all the object of the exercise, then the deficit will rise by the same percentage. What on earth is the point of doing that? It will only increase unemployment.

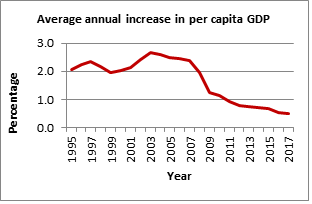

Second, it is critical we eliminate our deficit if we want to avoid a new financial crisis. At present we depend on Quantitative Easing to make good the loss of consumer demand from the deficit. However QE not only undermines our ability to save, it also cannot carry on for much longer. QE works by reducing interest rates, thereby encouraging people to borrow their future earnings to spend today. But inevitably tomorrow will soon become today and, oh dear; we have already spent our income. Not only that, we still have a hole in our economic barrel and we now have to start repaying the money we borrowed yesterday. It just won’t add up. The only way we can avoid Armageddon is to eliminate the deficit, and the only way of doing that is by devaluation and import tariffs, policies which are only available from a no-deal Brexit.

Third, if we leave without a trade deal then of course we will put in place an import tariff regime of our own; probably a mirror image of the one we are leaving, the EU one. I don’t know why nobody ever talks about this – it’s weird! Maybe it is because I am an accountant that I pick up on it, but if we did that it would be worth an extra £25bn a year to the Treasury. That’s huge. Yet by pursuing a trade deal, egged on by all those free trade fanatics baying in the background, she is proposing to throw that money away for nothing. How crazy is that? Surely no one in their right minds would do that? But no, that is the way she is going. At this rate she is set to drop us all in the biggest pile of poo ever produced by Woman.

Disastrously Theresa May started her negotiations by declaring openly that she wanted a trade deal. Michel Barnier must have smacked his lips with glee. “She wants something, so let’s make her pay!” he will have said to himself. And so he did, slamming on a €100bn ransom demand. That’s a ludicrous sum of money and he knows it, but probably thought of it as a negotiating anchor to be given back in stages for other goodies along the way. Unfortunately he is instead stuck with it because the other 27 countries have smelt the money and they are not now going to give it up. Barnier is a professional negotiator, whereas Theresa May clearly hasn’t a clue what she is doing. It’s no good being ‘tough and difficult’ if you don’t know what you are doing. That just makes her ‘stubborn and stupid’. We MUST divert her from this course, and that’s why a big vote for UKIP nationally is so important. I am even coming round to the LibDems idea of a second referendum. Not on membership but on the “Deal or No Deal” decision. We have trusted the people once, we can do so again. It may be the only way we can pull the plug on a disastrous deal.

OK. Let’s move on to funding. If we are to end austerity we have to find £70bn just to do that. Then to rebuild our public services we would need at least another £30bn, making a total of £100bn, or more safely let’s say £80bn, ie a total of £150bn. Is that possible? Well, consider this.

As I have just noted, the immediate fiscal benefit of leaving the EU is not just the £10bn saving on budget payments but also the import tariff revenues, giving a total benefit of £35bn. That’s about 2% of GDP. A lot of money and far more than any of the other parties can produce, but unfortunately not as much as the deficit. So what’s next?

Corporation Tax on multinationals. You may remember that at the Enniskillen G8 Summit a few years ago it was agreed that multinationals should declare their global profits. This would enable us to tax them on those profits so they could not squirrel them away in tax havens. The WTO was supposed to be working on a system whereby they would centrally assess the taxable profit of these multinationals and then apportion them to each nation in proportion to turnover so that those countries could then apply their own tax rates to them. It’s all gone a bit quiet, but if the WTO does deliver this system it could be worth about another £15bn of tax to the UK. Even if they don’t we can still do it unilaterally. There may be a few double tax issues, but we can just direct those to the WTO! So let’s add it on, total £50bn so far.

Now let’s get philosophical. UKIP is a libertarian party. Freedom of Conscience, Freedom of Expression, Freedom of Choice and Freedom for Britain are the four founding principles upon which the party is built. In this context that means giving people the opportunity to buy their ‘public’ services from the private sector if they want to on a means-tested basis rather than from the public sector. Roughly £400bn is spent on such services, ie health, education, care for the elderly and so on, so if about a quarter of people chose to do this, and on average contributed about a quarter of the cost as their means-tested payments, that would save a further £25bn. So now we are up to £75bn and ahead of the deficit!

I think it quite likely a significant number of people would do this, depending on the exact means-test gradient which we can alter as need be. After all private sector services are likely to be much more efficient, much more accessible and be provided to a much higher standard. That is because they are in an open competitive market, whereas the public sector is a monopoly and all monopolies profiteer. What is austerity after all but a form of profiteering? People will be prepared to pay for that.

Furthermore we could end the privilege tag that burdens our independent schools by simply means-testing their fees. That way any parent no matter how poor could consider an independent school education for their child. Our independent schools are among the best in the world, so much so that now around 25% of their pupils come from overseas, which is a huge export earner. But isn’t it a tragedy that more British children cannot benefit from them. Labour’s vindictive, pernicious and envious attacks on them have backfired making them even more privileged than before. It’s time we cherished and championed our independent schools and removed these burdens in return for a means-tested fee regime.

UKIP also supports grammar schools and free schools, and rightly so if that’s what parents want. Let us never forget that in a free society parents are ultimately responsible for their children, not the state. The state is there to support parents, not to replace them. However we also have a major problem in educating our least able and least focused children. These children need much more attention, smaller class sizes, better trained teachers, more pastoral care etc. etc. which all costs money. We should therefore be aiming to allocate more money per child to these children than to the brighter ones else we will be generating an underclass to the detriment of us all. Streaming allows you to charge means-tested fees for the faster streams and use that money for the slower ones without undermining social mobility.

What’s next? Privatising infrastructure projects, that’s what. HS2, Crossrail, power stations, bridges, tunnels etc are all costing the taxpayer a fortune. Furthermore many of them are probably uneconomic thereby undermining our economic growth rate rather than adding to it. You will never get an objective viability assessment from politicians or civil servants; there are too many hidden agendas in the background, whereas someone who is putting their own money in a competitive bid will surely do so. The long term or monopoly ones can be protected by cap and collar profit regulation to the benefit of both investor and taxpayer. So let’s put these projects up for auction, after the spec has been approved by Parliament, and award them to the higher bidder to build, run and own them. Let the City pay for them if they are viable, and if they are not: don’t do them! It’s a bit finger in the air, but I think we are reasonably safe putting in £25bn a year for this, giving a total now of £100bn.

Resource Management in our public services is next. There isn’t any. I know we all complain about the number of middle managers in the NHS and so on, but there is nothing at the top. For example if you look at the board of NHS England (yes I know it is a separate quango employing about 4000 staff, but it’s the nearest thing the NHS can manage) it is full of medics and civil servants. There is no Human Resources director, no Finance director, no IT director, no Facilities director and so on. In fact there are none of the resource focused directorships that you would see on the board of a private sector conglomerate. No wonder we are not training sufficient doctors and nurses and have to import so many from overseas. No wonder staff turnover rates are so high. What we need is the technique Arnold Weinstock perfected at GEC during the 60s, 70s and 80s. It’s not top-down management. In fact is localism management. I call it ‘Comparative Management by Results’. If we could just get a 5% improvement in efficiency on the £400bn we spend that would be worth another £20bn.

And finally – a Sovereign Wealth Fund. Now I don’t wish to speak ill of the politically dead, but surely George Osborne must count as one of the deadest of dead sheep ever to have inhabited the Treasury (if that isn’t a contradiction in terms!). I always got the impression he wasn’t even interested in his subject. I know Gordon Brown was a disaster, but at least he tried and came up with initiatives. Whereas as Osborne missed an absolute sitter right under his nose; using the fact that interest rates were on the floor to set up a Sovereign Wealth Fund to hedge our National Debt and un-funded pension liabilities, as well as in the long term to fund our public services out of investment income rather than taxes. Work though the figures and you will see it is money for old rope! Furthermore we can to some extent discount the future revenue stream to fund a current ongoing deficit. I am going to put in £30bn for that, and there’s my £150bn! I rest my case. Thank you very much.”

And now for the hustings address:

“Good evening L&G, and first may I say how pleased I am to be here at last. In 2015 I had to miss this hustings due to a prior engagement, so I hope you didn’t think I was avoiding you! Far from it, because may I also say how much I have enjoyed canvassing around Southall. You have been friendly, open-minded, curious, receptive and engaging, and that surely is all we candidates can ask of you. So thank you also for that.

Now I don’t want to spend the whole evening banging on about Brexit, but if you are interested in the technical arguments, about trade in particular, you can find them in my full Election Address, which is on our branch website at ukipealing.com. It is also on the Democracy Club website and on my own website at jepoynton.com.

I thought however it would be interesting just to reflect for a moment on the sudden fall in the expected Tory majority, and why that has happened. Some say it is because of Theresa May’s U-turns on social care and winter fuel payments, but I doubt it. They only affected the rich, and Labour are all in favour of taxing the rich, so where’s the difference?

No, I think it is because the British public have sensed she has already made a complete car-crash of these Brexit negotiations. By demanding a trade deal with the EU, up front, she has played straight into Michel Barnier’s hands. He has responded by demanding an enormous ransom of €100 billion – an impossible sum. She didn’t have to do that, and is now trying to wriggle out of it by saying that no deal is better than a bad deal. But we could have had a deal on non-trade issues anyway, because the EU wanted to deal with those first, and that would have suited us just fine because we could then simply have left at half-time. Now not even that option is available.

The odd thing though is that people have rushed to the opposite extreme, like lemmings over a cliff, straight into the lap of Labour. Do people really think Jeremy Corbyn could do better? Honestly, this is a man who cannot even add up, let alone negotiate. It would be a case of out the frying pan and into the fire. UKIP invented Brexit, we fought for it, we secured the referendum, we understand it. It’s our baby. So please, I beg of you, for everyone’s sake, let us deliver it.

But enough of Brexit already! What I really want to concentrate on this evening is “Beyond Brexit”. UKIP is a Libertarian party. Indeed so far as I can see it is the only libertarian party on the British political stage. The two main parties, Tories and Labour, are partisan and confrontational; still busily fighting the class wars of the early twentieth century, like a couple of Don Quixote’s tilting at windmills.

So what exactly do I mean by Libertarian? I could talk about Freedom of Conscience. I could talk about Freedom of Expression, or Freedom of Choice, and of course of Freedom for Britain. But as is so often the case the best definition comes from considering the opposite, and for that I can do no better than John Stuart Mill’s famous dictum about the Tyranny of the Majority. That simply means that in a democratic society it is not acceptable for the majority to decide everything, because that leaves no room for minority rights or individual responsibility – for true diversity if you like.

We had a classic example of the Tyranny of the Majority a few years ago when a Labour government closed down Catholic adoption agencies. They were doing a great job and harming no one, but because they were serving only the Catholic community they had to go. They simply did not fit with Labour’s socialist totalitarian straight-jacket ideology. Here in Southall you have a number of Free Schools. They likewise would not survive a Labour Government. Labour hates diversity and freedom of choice. All schools have to be comprehensive schools, so Grammar Schools, Free Schools and Independent schools are all in their firing line. To us, parents are ultimately responsible for their children, not the State. The State is there to support parents, not to replace them.

They talk about abolishing privilege, and I get that. But you know there is a much simpler way of doing it. Simply means-test independent school fees. That way any parent, no matter how poor, could consider an independent or grammar school education for their child and at the same time the cost to the Treasury is reduced so more can be spent on the slower stream schools, which is where it is really needed. Our independent schools are amongst the best in the world. 25% of their pupils now come from overseas. And UKIP’s immigration policies would not affect that at all. We are not concerned about temporary comings and goings. It is permanent settlement and citizenship which is the problem. But what a tragedy that more British children cannot now attend these schools. Labour’s vindictive, pernicious, jealous and small-minded policies have actually increased the privilege rather than reduce it! And now they want to add VAT as well.

But let me broaden the picture. Why shouldn’t all our non-security public services be available from the private sector on a means-tested basis? That would be real freedom of choice. It would not only ensure that the supply of services, such as care for the elderly, kept up with demand in an efficient manner, it would also reduce the pressure on our existing publicly owned services, thereby enabling them to do a better job. It is after all the purchase decision in an open competitive market that drives efficiency and drives quality of service, and that is why I believe a significant proportion of the population would chose the private sector even thought they would have to pay something affordable for it. That could save the state some £25bn a year whilst at the same time improving services. People talk about the private sector profiteering, but it is monopolies that profiteer, whoever owns them. After all, what is austerity if not profiteering? The public sector is by far the worst offender.

In summary I am asking you to vote UKIP at this election not only to rescue Brexit but also to share with me my vision for a truly libertarian future for our country. For us this election about votes, not seats. Last time we polled over 4 million votes. That had an impact. If we can repeat that or improve on it this time it will again have an impact. So a vote for UKIP will count and be significant.”