1. UKIP Leadership Statement

Our Party has just been through a very difficult two years. We are down, but certainly not out. I believe we have a unique and vital role to play in British politics as the only significant libertarian party available; a libertarian rose within a thicket of totalitarian thorns. The phoenix can and will rise from the ashes.

I have no intention of resurrecting any of the internal disputes we have experienced and will not tolerate personal remarks, but as a member of the ill-fated constitutional review team and as a professional management consultant, we were able to identify a number of ways in which I believe our constitution could be made more robust, reliable and accountable to the membership. I accept that the NEC should have the final say on such matters subject to approval by the membership and intend to work with them rather than around them, being by nature a reconciler rather than a polarizer, putting forward a series of proposals for changes to the constitution. The NEC can then call the necessary EGMs to make the changes if they agree. Likewise I hope the NEC will allow me the final say on policy, assuming I do not contravene the constitution.

I intend to ask Ben Walker to continue as Party Chairman both because I think he has done an excellent job in holding the party together and because I value an element of continuity given that 10 NEC seats are also up for election. We can consider separately whether that position has too much power and whether for example the NEC should elect its own separate chairman from amongst its members. I am keen to encourage past members to return but suspect they will want to see some constitutional change.

I intend to place UKIP at the centre of the political spectrum between Labour and the Tories as a radical, social libertarian party. Constructive change instead of the revolutionary, destructive, classist change offered by totalitarian socialism, and in place of Conservative complacency and totalitarianism now they are fully under the thumb of Big Business. Our message to the voters is simple. If you want change, change the way you vote. You have to play your part if it is to happen. Don’t worry, we will look after you. The ‘solidarity’ toted by Labour is meaningless. It is self-serving and unpatriotic. Don’t fall for it.

We already have a good and developing manifesto and I thank all those who have contributed. Even so in my opinion it requires more focus so the voters can see immediately what is both unique and valuable in our offering. So here are four headline policies I want to emphasize. You can find much more on my website at jepoynton.com. You can also find a CV for me on the UKIP party website under London.

1. A quota system for total immigration set at at least 50,000 fewer than the number who emigrate voluntarily each year. This country has suffered immense damage over the years from open borders – to our economy, our environment (25% of all animal species and 50% of all bird species may become extinct here due to habitat loss), the homeless, our public services and, yes, to cultural displacement. It is not enough to acquiesce in a reduction in immigration; we have actually to reverse the process if we are to survive. It is also a fallacy to say we need these immigrants for our economy. We don’t. They are consumers as well as workers and most on balance take out more than they put in. By restricting immigration we can force Big Business to train British citizens, update redundant skills and provide all the jobs we need. If there are still job vacancies we can simply reduce demand in the economy to match and vice versa.

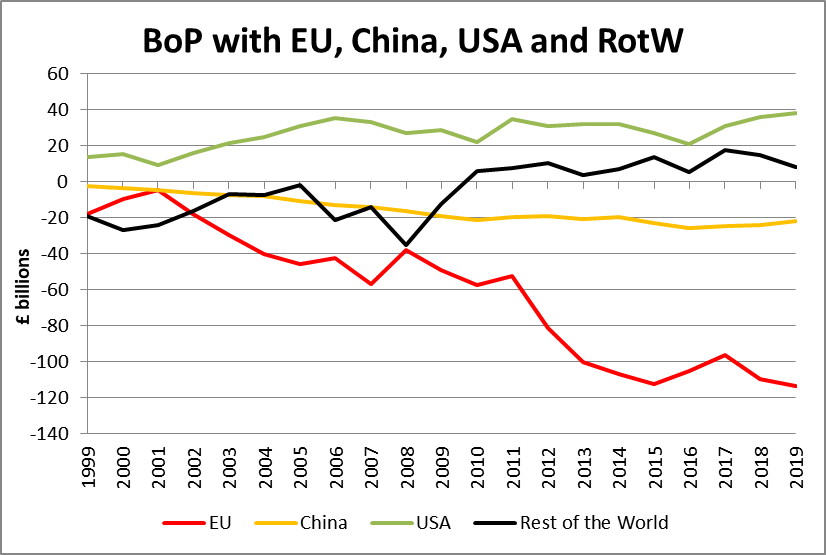

2. Rip up Boris’s catastrophic trade deal with the EU and revert to trading on WTO terms as we have always advocated. Nobody appears to have noticed, least of all our dozy officials in Whitehall, that we now have a massive 6% GDP deficit on trade with the EU (in balance 20 years ago) whilst at the same time our trade with the rest of the world has moved firmly into a 1% surplus. There is only one way this divergence could have happened. Those bastards in Brussels have been deliberately and progressively but surreptitiously stealing our trade by blocking our exports. We need that £120bn a year for all sorts of things from dealing with climate change and funding our pensions to social care, the NHS and tax cuts, but Boris has now locked us into this deficit. Whose side is he on FFS? We must also wrap up the residual issues of fishing, Northern Ireland and human rights. Brexit is most certainly NOT done. We must honour our prime constitutional objective.

3. Stand up for free speech and reform the police and the management of our public services generally. Free speech is about listening to both sides of an argument. This is impossible if one side is being supressed in the name of woke totalitarianism. I would never condone gratuitously offensive behaviour and unconditionally condemn racist banter at football grounds, but ultimately it is a matter for moral persuasion not the law. To Islamaphobes I say your concerns must be taken seriously but the problem is not Islam but the failure of our pathetic, guilt-sodden establishment to bring to justice all criminals regardless of their religion or ethnicity. I also support a federal approach to multiculturalism, thereby preserving our own indigenous culture and identity as well as those of others, but that will only work with cultural demographic stability. Nobody wants to be stuffed into the socialist blender, including the incoming communities.

4. Welfare, housing and regional policy reform. Housing must be built up North where the brownfield sites are thereby relieving density in the South, with regional policy using local tax discounts to persuade the jobs and people to follow. We must also end breeding for benefits. It is crazy to be paying people to have babies in these circumstances anyway but it will also assist in reducing cultural displacement, the rate of change in diversity.

2. NEC Manifesto statement

Our Party has just been through a very difficult two years. We are down, but certainly not out. I believe we have a unique and vital role to play in British politics as the only significant libertarian party available; a libertarian rose within a thicket of totalitarian thorns. The phoenix can and will rise from the ashes.

The role of the NEC is vital in this, ensuring both the leader and the executive comply with the constitution. We must make sure all key decisions are made by and through the NEC and not behind anybody’s backs, and we must propose by EGM to the membership changes to the constitution if and when we feel these are needed. I hope we can improve the accountability of NEC members to the membership, perhaps by allocating an NEC member to each region so all members and branches know who their own representative is on the NEC.

We shall have an almost all-new NEC as a result of these elections, so let’s hope that is sufficient to draw a line in the sand over past personality issues, if possible leading to an amnesty to ex-members who have now ‘done their time’.